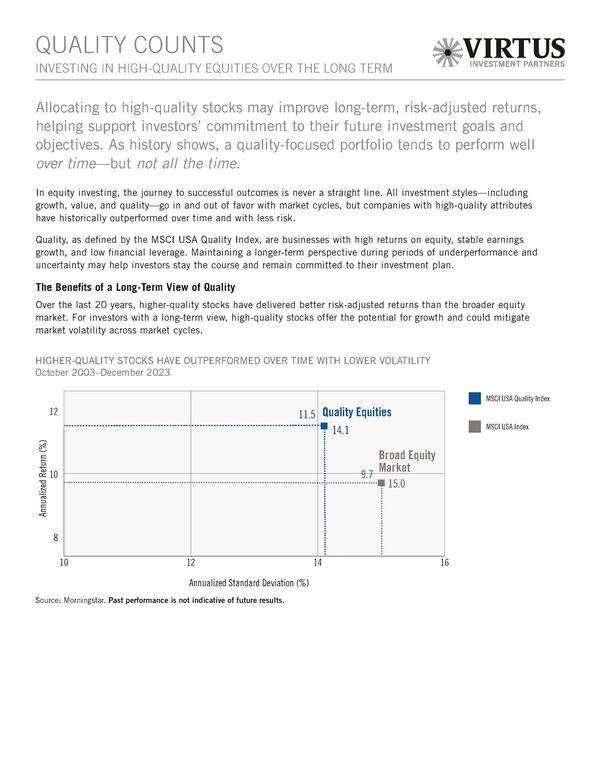

Allocating to high-quality stocks may improve long-term, risk-adjusted returns, helping support investors’ commitment to their future investment goals and objectives. As history shows, a quality-focused portfolio tends to perform well over time—but not all the time.

In equity investing, the journey to successful outcomes is never a straight line. All investment styles—including growth, value, and quality—go in and out of favor with market cycles, but companies with high-quality attributes have historically outperformed over time and with less risk.

Past performance is not a guarantee of future results.

Please consider a Fund’s investment objectives, risks, charges, and expenses carefully before investing. For this and other information about any Virtus Fund, contact your financial professional, call 800-243-4361, or visit virtus.com for a prospectus or summary prospectus. Read it carefully before investing.

All investments carry a certain degree of risk, including possible loss of principal.

Not all products or marketing materials are available at all firms.

Not insured by FDIC/NCUSIF or any federal government agency. No bank guarantee. Not a deposit. May lose value.

2629419