Educational resources designed to help investors put markets in perspective.

What If You Invested at the Peak Right before the 2008 Crisis?

The best defense against significant losses in the stock market is a long enough time horizon. Obviously, no one is good enough to put all of their money in at the bottom or unlucky enough to put all of their money in at the top on a consistent basis. But, it’s worth pointing out that the long-run in the stock market is pretty similar to what we’ve seen since 2007.

So much effort in investing goes toward identifying “winners.” In the world of actively managed mutual funds, we search for managers who can outpace their peers and beat the market.

Missing the Best Days in the Market is Costly

Trying to time the market to miss the lows likely means missing the highs too. Investors who stay on the sidelines and miss the best trading days have the odds stacked against them.

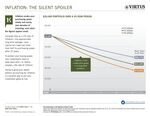

Inflation: The Silent Spoiler

Over decades of investing, inflation can erode an investor’s buying power slowly—but surely—even when the figures appear small.

Exploring the inverse relationship between interest rates and bond prices.

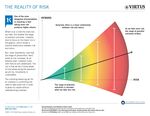

Generally, there is a linear relationship between risk and return, but not always.

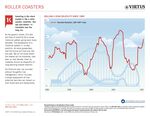

Investing in the stock market is like a roller coaster: volatility—the ups and downs—is inevitable over the long run.

The Marathon of Investing

Long-term investors must be prepared to endure significant market declines and periods of intermittent volatility.