Continued disinflation and policy easing helped support improvement in EM growth prospects.

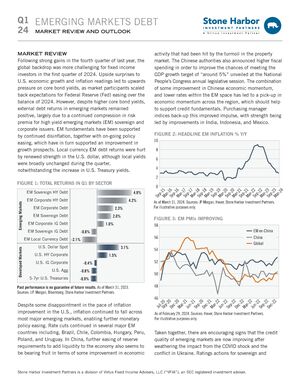

Following strong gains in the fourth quarter of last year, the global backdrop was more challenging for fixed income investors in the first quarter of 2024. Upside surprises to U.S. economic growth and inflation readings led to upwards pressure on core bond yields, as market participants scaled back expectations for Federal Reserve (Fed) easing over the balance of 2024. However, despite higher core bond yields, external debt returns in emerging markets remained positive, largely due to a continued compression in risk premia for high yield emerging markets (EM) sovereign and corporate issuers. EM fundamentals have been supported by continued disinflation, together with on-going policy easing, which have in turn supported an improvement in growth prospects. Local currency EM debt returns were hurt by renewed strength in the U.S. dollar, although local yields were broadly unchanged during the quarter, notwithstanding the increase in U.S. Treasury yields.

The commentary is the opinion of the subadviser. This material has been prepared using sources of information generally believed to be reliable; however, its accuracy is not guaranteed. Opinions represented are subject to change and should not be considered investment advice or an offer of securities.

All investments carry a certain degree of risk, including possible loss of principal.

Past performance is not indicative of future results.