Tapping into

the Value of Water

The Global Water Crisis

1% of Earth's

water is potable.

Water Is Facing

Unprecedented Demand2

69% of all water consumption

is used for agriculture.

Food demand to increase by

60% by 2050

12% of all water is used for

domestic purposes.

Domestic demand is expected to increase

300% in Africa and Asia and 200% in Central

and South America by 2050.

19% of all water is used for

industrial purposes.

Global water demand for manufacturing

will increase by 400% by 2050.

Water Resource Issues on the Rise

Irresponsible extraction,

inequitable access,

pollution,

and climate change

all contribute to the water crisis.

The Infrastructure Challenge4

Some water infrastructure in the United States is more than 100 years old and leaking, leaking 20% of its water throughput.

There is a water main break every two minutes and an estimated 6 billion gallons of treated water lost each day in the U.S.

That's enough to fill over 9000 olympic swimming pools.

Yet Water Has Been a Compelling Investment

Past performance is not indicative of future results.

Source: Virtus Performance & Analytics. Data as of S&P Global Water Index inception 11/16/2001.

VIRTUS DUFF & PHELPS WATER FUND Be a Part of the Clean-Water Solution

Supply

Exploration,

engineering,

and design

Wastewater

treatment

Pumping stations

and pipelines

Well

drilling

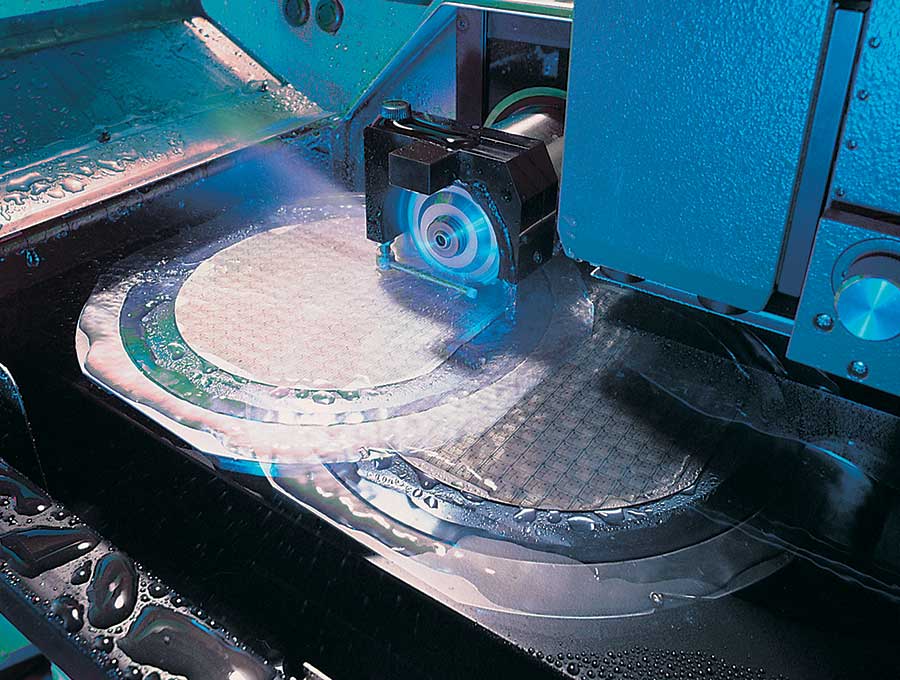

Desalination

equipment

Efficiency

Advanced

irrigation equipment

Drought

resistant crops

Smart meters

Leak detection

devices

Automation

controls

Quality

Disinfection

chemicals

Sanitary

appliances

Wastewater

technology

Filtration

Monitoring

and testing

Key Features

Precision exposure to sustainable water

Targets pure-play companies, committed to addressing water scarcity, increasing water quality, and enhancing water efficiency. Investors may benefit fully from the secular growth trend that the water theme represents globally.

A resilient portfolio in ever-changing market conditions

The Fund focuses on what the manager considers high-quality water stocks backed by strong structural drivers, seeking to deliver stability in difficult market environments while generating attractive long-term growth and returns.

Time-tested experience in Water and ESG investing

The Duff & Phelps team has decades of experience in listed real assets and water-related investment expertise, engaging in a recurring dialogue with global water leaders. The Fund is aligned to four of the 17 United Nations Sustainable Development Goals (SDG), with a focus on Goal 6, “Clean Water and Sanitation,” offering potential exposure to financial, environmental, and social value.

The Takeaway

Amid a global warming crisis, companies addressing supply, efficiency, and quality can make for a timely investment opportunity with the potential to generate financial, environmental, and social alpha.

Learn more about the investment opportunity and the Virtus Duff & Phelps Water Fund.

Sources:

2 Source: UN World Water Development Report 2021 (Valuing Water)

3 Source: Water Footprint Network (2008); Ecolab, Closing Keynote Presentation from the Financial Times Water Summit from Doug Baker, CEO of Ecolab (October 2015)

4 Source: 2021 Report Card for America’s Infrastructure, www.infrastructurereportcard.org

IMPORTANT RISK CONSIDERATIONS:

Market Volatility: Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio manager(s) to invest the portfolio’s assets as intended. Issuer Risk: The portfolio will be affected by factors specific to the issuers of securities and other instruments in which the portfolio invests, including actual or perceived changes in the financial condition or business prospects of such issuers. Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk. Water-Related Risk: Because the portfolio focuses its investments in water-related companies, it is particularly affected by events or factors relating to this sector, which may increase risk and volatility. Focused Investments: To the extent the portfolio focuses its investments on a limited number of issuers, sectors, industries or geographic regions, it may be subject to increased risk and volatility. Foreign Investing: Investing in foreign securities subjects the portfolio to additional risks such as increased volatility, currency fluctuations, less liquidity, and political, regulatory, economic, and market risk. Sustainable Investing: Because the portfolio focuses on investments in companies that the Manager believes exhibit strong environmental, social, and corporate governance records, the portfolio’s universe of investments may be smaller than that of other portfolios and broad equity benchmark indices. Prospectus: For additional information on risks, please see the fund’s prospectus.

INDEX DEFINITIONS

The MSCI AC World Index (net) is a free float-adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The S&P Global Water Index (net) is a modified capitalization-weighted index comprised of 50 of the largest publicly traded companies in water-related businesses that meet specific invest ability requirements. The index is designed to provide liquid exposure to the leading publicly-listed companies in the global water industry, from both developed markets and emerging markets. The indices are calculated on a total return basis with net dividends reinvested. The indices are unmanaged, their returns do not reflect any fees, expenses, or sales charges, and they are not available for direct investment.

Please consider a Fund’s investment objectives, risks, charges, and expenses carefully before investing. For this and other information about any Virtus Fund, contact your financial representative, call 800-243-4361. Read it carefully before investing.

Not insured by FDIC/NCUSIF or any federal government agency. No bank guarantee. Not a deposit. May lose value.

Did you know it takes 2000 gallons of water to

produce one pound of beef?

Did you know it takes 2000 gallons of water to

produce one pound of beef?

But only 25 gallons to produce a

But only 25 gallons to produce a