By Ben Carlson

A Wealth of Common Sense

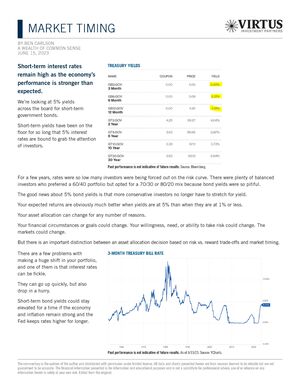

Short-term interest rates remain high as the economy’s performance is stronger than expected.

We’re looking at 5% yields across the board for short-term government bonds.

Short-term yields have been on the floor for so long that 5% interest rates are bound to grab the attention of investors.

For a few years, rates were so low many investors were being forced out on the risk curve. There were plenty of balanced investors who preferred a 60/40 portfolio but opted for a 70/30 or 80/20 mix because bond yields were so pitiful.

The good news about 5% bond yields is that more conservative investors no longer have to stretch for yield.

Your expected returns are obviously much better when yields are at 5% than when they are at 1% or less.

Your asset allocation can change for any number of reasons.

Your financial circumstances or goals could change. Your willingness, need, or ability to take risk could change. The markets could change.

But there is an important distinction between an asset allocation decision based on risk vs. reward trade-offs and market timing.

The commentary is the opinion of the author and distributed with permission under limited license. All data and charts presented herein are from sources deemed to be reliable but are not guaranteed to be accurate. The financial information presented is for information and educational purposes and is not a substitute for professional advice; use of or reliance on any information herein is solely at your own risk. Edited from the original.

2962549