By Ben Carlson and Sean Russo

A Wealth of Common Sense

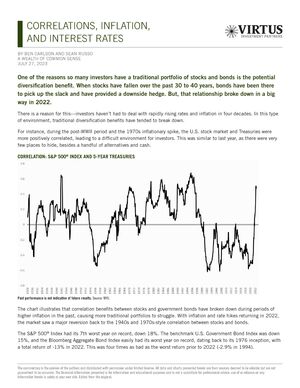

One of the reasons so many investors have a traditional portfolio of stocks and bonds is the potential diversification benefit. When stocks have fallen over the past 30 to 40 years, bonds have been there to pick up the slack and have provided a downside hedge. But, that relationship broke down in a big way in 2022.

There is a reason for this—investors haven’t had to deal with rapidly rising rates and inflation in four decades. In this type of environment, traditional diversification benefits have tended to break down.

The commentary is the opinion of the author and distributed with permission under limited license. All data and charts presented herein are from sources deemed to be reliable but are not guaranteed to be accurate. The financial information presented is for information and educational purposes and is not a substitute for professional advice; use of or reliance on any information herein is solely at your own risk. Edited from the original.

3081587