A Pivot for Rate Cut Pricing

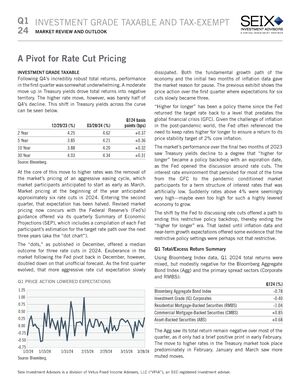

- Following Q4’s incredibly robust total returns, performance in the first quarter was somewhat underwhelming.

- The glide path to the objective of 2% price stability encountered some turbulence. Both January and February core inflation data came in above expectations, and short-term annualized rates moved up since year-end.

- Given the challenges around forecasting inflation over this very unique cycle, a little more humility would seem warranted, particularly from a Fed that would prefer not to lose credibility again. Perhaps it is more indicative of the overall pressure the Fed is under to cut rates.

- With each passing quarter, more lower-cost debt rolls off the Treasury’s balance sheet, only to be refinanced at much higher rates. Without an extremely aggressive easing cycle, this dynamic may be here to stay.

The commentary is the opinion of the subadviser. This material has been prepared using sources of information generally believed to be reliable; however, its accuracy is not guaranteed. Opinions represented are subject to change and should not be considered investment advice or an offer of securities.

Bonds: Bonds may offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return. Generally, a portfolio's fixed income securities will decrease in value if interest rates rise and vice versa.

All investments carry a certain degree of risk, including possible loss of principal.

Past performance is not indicative of future results.

3513273